Who Put the Brakes on Med Devices Sector Growth?

April 11, 2023 | Tuesday | Features | By Sanjiv Das

The med devices sector in India seems to be lost somewhere when it comes to the concept of manufacturing devices under the ‘Make in India’ initiative. Though projected to reach $50 billion by 2025, the sector is largely import driven where medical devices worth Rs 63,200 crore were imported in 2021-22, up 41 per cent from Rs 44,708 crore in 2020-21. The Indian medical device market is driven by 70-80 per cent imports from countries such as the US, China and Germany.

Image credit: shutterstock

According to statistica.com, India’s medical devices segment is projected to touch $5.99 billion in 2023 and the market volume of the cardiology devices segment, the largest segment in the medical devices sector, is projected at $0.85 billion. The revenue is expected to show an annual growth rate (CAGR 2023-2027) of 8.35 per cent, resulting in a market volume of $8.26 billion by 2027.

The government has set up a Medical Device Park Scheme with a total financial outlay of Rs 400 crore to establish common facilities across several states. The government has also provided various incentives, such as tax exemptions and subsidies, to promote the growth of the medtech sector. Additionally, the government is also making concerted and coordinated efforts on R&D and innovation in the pharma medtech sector to indiscriminately develop cutting-edge products and technologies.

Medical device imports continued to grow at an alarming level by 41 per cent in FY22, on account of low duties and convenience to import. While initiatives like Make in India and Atmanirbhar Bharat Abhiyaan have given a much-needed thrust to the manufacturing of medical devices in the country, schemes like the Production Linked Incentive (PLI) Scheme and promotion of Medical Device Parks still need a boost for promoting domestic manufacturing of medical devices.

Prime Minister Narendra Modi, during a recently held webinar on ‘Health and Medical Research’, said that several new schemes have been launched in the last few years given the possibilities in the pharma and medical device sector. More than Rs 30,000 crore have been invested in schemes like PLI whether it is the bulk drug park or developing the medical device park systems.

The PM further mentioned that this market is going to touch Rs 4 lakh crore in the next two to three years. Work has begun to acquire skilled manpower for future medical technology, high-end manufacturing and research initiatives. Biomedical engineering or similar courses will also be introduced for training in the manufacturing of medical equipment, in IITs and other institutions.

Himachal Pradesh recently signed 17 Memoranda of Understanding (MoU) amounting to Rs 2,110 crore at the pharma-expo in Mumbai. Himachal Pradesh showcased the pharma ecosystem of the state to invite potential pharma device players for investments in the upcoming Medical Devices Park in the state. The state has a 300-acre medical devices park in Nalagarh. According to the state government, it will provide liberal incentives and highly subsidised utility rates for manufacturers in medical devices parks.

The growth story

In March 2022, Wipro GE Healthcare announced a new 35,000 sq ft medical device manufacturing factory in Bengaluru. It will manufacture CT, ultrasound imaging devices, cath lab equipment, patient monitoring solutions, ECG machines and ventilators. In April of the same year, Siemens Healthineers started its new computed tomography scanners manufacturing facility in Bengaluru.

Apart from this, the government-sanctioned four medical device parks (in Madhya Pradesh, Tamil Nadu, Himachal Pradesh, and Uttar Pradesh) of about 1,326 acres and will also provide a maximum grant-in-aid of Rs 400 crore (Rs 100 per park) or 70 per cent of the common infrastructure cost, whichever is less.

AMTZ in Andhra Pradesh supplied 1 million RT-PCR kits per day at the peak of the pandemic. Transasia Diagnostic Pvt Ltd (TDPL) launched the first-in-India Transasia-Erba Monkeypox RT-PCR kit in August 2022, and the company can manufacture more than 200 million Monkeypox RT-PCR kits per month.

Sahajanand Medical Technologies (SMT) has set up Asia's largest stent manufacturing and R&D facility at Hyderabad Medical Devices Park. The facility aims to manufacture more than one million stents and two million balloon catheters.

However, there seems to be some mismatch between what the government is promoting and what the industry is demanding.

Unheard voices of the industry

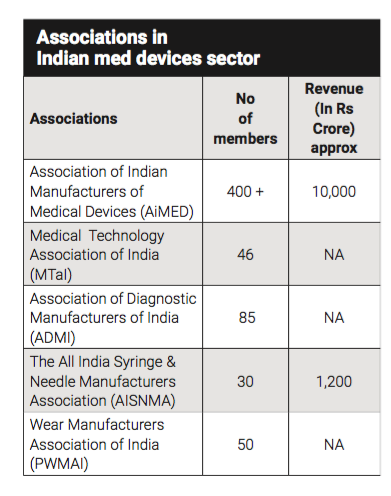

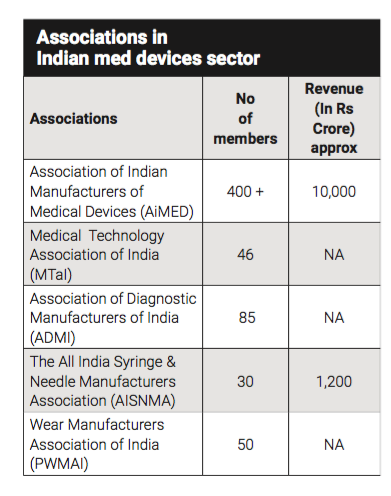

Several associations that represent the medtech sector in India, such as the Association of Indian Medical Device Industry (AIMED) and the Medical Technology Association of India (MTaI), have been actively engaging with the government to address issues faced by the sector. While it may be beneficial for these associations to come together to form a larger lobby, it is important to recognise that each association has its own unique goals and objectives.

Pavan Choudary, Chairman, MTaI says, “Several of the trade associations already have or claim to have a large number of members, therefore it is not a matter of forming a larger group. Rather, compelling arguments and actual investments should tilt the scale in favour of the side which has them. As far as we know, the biggest investments in the sector, whether in manufacturing or R&D, come from global investors. These remarkable contributions, which are spread across the country, have been instrumental in the growth of the medtech industry.”

MTaI members have 12 state-of-the-art manufacturing units and eight research and development centres with footprints in states like Maharashtra, Haryana, Telangana, Tamil Nadu, Himachal, Gujarat, Karnataka, and Punjab. MTaI member companies also train more than two lakh healthcare workers annually.

According to Jatin Mahajan, Secretary, Association of Diagnostic Manufacturers of India (ADMI) and MD, J Mitra & Company, “There is absolute unity in diversity. There are numerous associations within the overall ambit of medtech and they represent the unique subsets within it. Naturally, for all associations, it is paramount to first address their members' problems and primary needs before looking at other associations’ issues or needs. The individual associations continue to make representations and recommendations to the Centre, seeking redressal. A primary problem for one segment may be secondary for another and non-existent for the third. The associations continue to join hands and make collective representations for common issues.”

AiMeD is an umbrella association of Indian Manufacturers of Medical Devices and is quite vocal for the causes of the med devices sector. Alongside AiMeD there are associations like the All India Syringe & Needle Manufacturers Association (AISNMA), the association for needle manufacturers, a manufacturing association for surgical dressings, the manufacturing association for surgical blades, Preventive Wear Manufacturers Association of India (PWMAI) that takes care of PPE coveralls and gowns, masks etc.

Says Rajiv Nath, Forum Coordinator, AiMeD, “We have a common agenda and we commonly seek these points and the smaller regional associations operate specific associations that look at AiMeD to lead the way and for wider leadership. Unfortunately, other associations like FICCI, CII, are dominated by overseas manufacturers having offices in India who, in many cases, don't even have a factory in the country but claim to be the voice of the industry. Unless they produce in India, they cannot feel the pains of manufacturers in India.”

According to Dr Sanjeev Relan, Chairman, Preventive Wear Manufacturers Association of India (PWMAI), the industry is gearing up for compliance with medical device reporting (MDR), which will help Indian manufacturers go global as MDR will give a boost to manufacturing of quality products which are at par with global standards. He further mentions, “There are a few hurdles like coordination gap between Central and State Regulators, unavailability of complete ecosystem which includes testing labs and skilled manpower, willingness from industry to upgrade due to lack of capital. I believe if the above hurdles are taken care of, India can soon be a manufacturing hub for medical devices.”

Does the Govt favour Imported Products?

The government has come up with multiple initiatives and policies to promote India's medical device sector. A wide range of medical devices, from consumables to implantable medical devices that were not produced in India a decade ago, are now indigenously manufactured. However, a large number of devices and diagnostic equipment are still imported.

Having said so, there is a need for the government to take some urgent steps to address the industry's pain points. As we are aware that clubbing medtech with drugs and cosmetics within the regulatory structure has created a lot of grey areas, although there is nothing common between them.

According to Aravind Viswanathan, CEO, Transasia Bio-Medicals, “Even though the government has created a policy for purchase preference for Made in India products, unfortunately, this policy has not worked. In 95 per cent of government purchases, there is no preference given to 'Made in India' as the state governments are not implementing this policy”.

It is exactly not clear on why the government is shying away from buying India-made products where data suggests that more imports are happening. One of the major reasons may be due to low quality products as compared to globally produced devices. It may be also due to lack of skilled manpower and high cost of equipment.

Focus on Innovation & Quality

The domestic manufacturing unit needs a big boost from the government. An urgent need to offer technologically advanced products that are customised for the Indian market is the need of the hour to improve the quality of products manufactured locally.

Manufacturers need to ensure that the products are available to Indian patients at affordable rates. An increase in domestic manufacturing capacity and competitiveness would help the country don a new identity of ‘Making in India for the World’. This will also help India's exports grow at a record pace.

Sachidanand Upadhyay, MD & CEO, Lord’s Mark Industries (LordMed, healthcare division of Lord’s Mark Industries) says, “The government exhorted the health sector to improve and upgrade manufacturing with the use of technology to reduce dependence on the large imports that India makes. Indian manufacturers can focus on innovation, R&D and quality to compete with imported medical devices.”

The government should further promote medtech parks with specific ecosystems, benefits and sops. There should be easy access to standard testing and infrastructure facilities through the creation of world-class common infrastructure facilities for increased competitiveness. This will result in a significant reduction in the cost of production of medical devices leading to better availability and affordability of medical devices in the domestic market.

Ganesh Sabat, CEO, SMT mentions, “As we envision to become a global hub by 2047, I would request the government to seize this opportunity to expand and accept R&D in the medtech sector done by local players, hence playing a pivotal role to revive the image of the domestic industry, who get intimidated by demands of US FDA/CE certifications.

With innovation in this sector happening rapidly, R&D incentives need to be re-looked at in addition encouraging procurement of innovative devices in central and state government purchase programmes, tax exemptions in medical devices parks where shared infrastructure to support medtech innovation such as shared raw material supplier base, testing services, among others are available.

Besides, government and private companies should collaborate and make an effort to manufacture products of all ranges. Key education institutes like IITs should be enabled to use their might and research to ensure a futuristic focus on medical research, collaborative research and R&D to develop state-of-the-art medical technology, which is core to enhanced care delivery.

The road to success is not easy and several challenges need to be taken into account. One of the major challenges is the lack of monitoring of unscrupulous Chinese devices that are marketed as Made in India products, impacting Indian manufacturers and patients alike. Ease of doing business by providing access to infrastructure, balanced policies and the right training to young people are some of the measures that need to be taken into account before the medical devices sector can see the day of light in the long run and make India proud.

Associations need to work together for the betterment of the industry. While the government may not have provided as much relief as some may have hoped for, it is important to acknowledge the progress that has been made in recent years. However, several policy changes are required to further accelerate the Medtech sector’s growth. Incentivising R&D should become a norm and a robust industry-academia collaboration model will give the sector the much-needed boost.

Sanjiv Das

(sanjiv.das@mmactiv.com)