Sahajanand Medical Technologies files DRHP for IPO

July 26, 2025 | Saturday | News

SMT Limited's revenue from operations increased by 13.67% to Rs 1,024.88 crore in Fiscal 2025

image credit- shutterstock

Mumbai-based Sahajanand Medical Technologies (SMT) Limited, a Class III and Class C/D medical devices company with a portfolio of technologically advanced medical devices across vascular and structural heart intervention, has filed its Draft Red Herring Prospectus (DRHP) with capital markets regulator, Securities and Exchange Board of India (SEBI) to raise funds through Initial Public Offering (IPO).

The IPO, with a face value of Re 1, is entirely an offer-for-sale up to 27,644,231 equity shares by promoters, and investor selling shareholders. The offer also includes a subscription reservation with a discount to eligible employees in the employee reservation portion.

Samara Capital Markets Holding Limited, Kotak Pre-IPO Opportunities Fund, Plutus Wealth Management LLP, and Ashish Kacholia are the major shareholders in the company.

Offer for sale consists of shareholders up to 2,700,000 Equity Shares by Shree Hari Trust, up to 2,700,000 Equity Shares by Dhirajkumar Savjibhai Vasoya, up to 12,958,126 Equity Shares by Samara Capital Markets Holding Limited, up to 2,615,750 Equity Shares by Kotak Pre-IPO Opportunities Fund, and up to 6,670,355 Equity Shares by NHPEA Sparkle Holding B.V.

The offer is being made through the book-building process, wherein not more than 50% of the offer is allocated to qualified institutional buyers, and not less than 15% and 35% of the offer is assigned to non-institutional and retail individual bidders respectively.

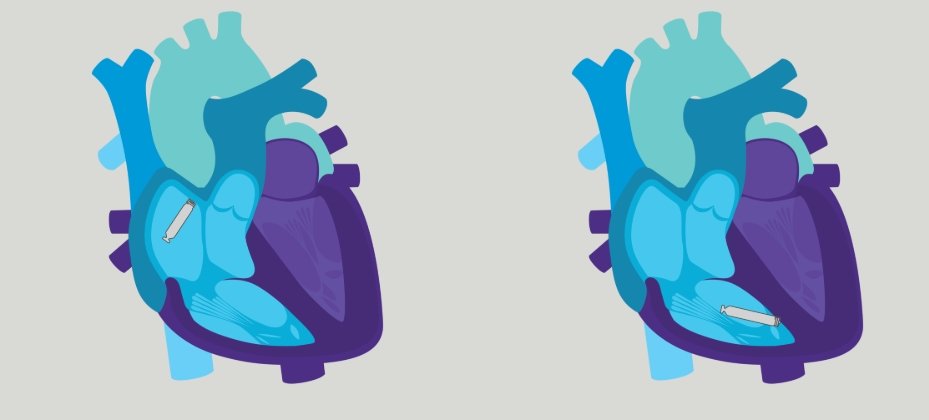

It is a R&D-driven company engaged in the development of Class III and Class C/D medical devices, with an emphasis on Vascular Intervention (VI) and Structural Heart (SH).

It has built a strong clinical foundation for its flagship products – Supraflex Cruz, Hydra, Pipit and Cocoon, supported by 72 clinical studies (comprising 60 completed studies and 12 ongoing studies) across diverse geographies and patient populations.

SMT Limited's revenue from operations increased by 13.67% to Rs 1,024.88 crore in Fiscal 2025 from Rs 901.60 crore in Fiscal 2024 primarily due to an increase in the sale of devices driven by higher sales in Europe and the rest of the world, primarily led by the structural heart vertical. Profit for the year stood at Rs 25.15 crore in Fiscal 2025 compared to a loss after tax of Rs 7.35 crore in Fiscal 2024.